Groundbreaking Toolkit (80 page whitepaper +Etemplates) that fixes annual planning nightmares (late nights, errors, too much detail)

The annual plan is wrong as soon as the ink has dried

The annual planning process is part of the trifecta of lost opportunities for a corporate accountant. The other two being the year-end accounts and the monthly accounts processes. Annual planning may have worked from Henry Ford but no longer in the 21st century. All three exercises keep the corporate accountant locked into processing and reporting leaving little time for added value activities. It is interesting to note that we seldom get thanked for preparing the annual accounts, for controlling the annual budget process or for preparing the month-end accounts.

The annual planning process is part of the trifecta of lost opportunities for a corporate accountant. The other two being the year-end accounts and the monthly accounts processes. Annual planning may have worked from Henry Ford but no longer in the 21st century. All three exercises keep the corporate accountant locked into processing and reporting leaving little time for added value activities. It is interesting to note that we seldom get thanked for preparing the annual accounts, for controlling the annual budget process or for preparing the month-end accounts.

A two week annual planning process sounds impossible yet it is achieved. It takes good organization and recognition that the annual planning process is not adding value. Instead it is undermining an efficient allocation of resources, encouraging dysfunctional budget holder behaviour, negating the value of monthly variance reporting and consuming huge resources from the Board, senior management team, budget holders, their assistants and of course the finance team. At best you have a situation where budget holders have been antagonized, at worst budget holders who now flatly refuse to co-operate!

Find more about this ground breaking toolkit

The ten reasons why you should stop annual planning

The time is right for quarterly rolling forecasting and quarterly rolling planning as the standard annual planning process:

- Takes too long, costs too much – too much detail and too many iterations.

- Does not help run the business as it is out of date as soon as the ink has dried

- Leads to dysfunctional behaviour, building silos and gaming the system

- Undermines monthly reporting (monthly budgets are poor targets)

- Is an anti-lean process

- Often has allocations that budget holders have no control over

- Forces decisions to be made too early and often too high up in the organisation

- Prevents value adding activities that were not in the budget

- Is a bad yardstick for evaluating performance

- Based on planning and central control which has MacGregor’s theory X premise “that you cannot trust people”

Smart organizations do not have an annual planning process anymore. Instead, they use quarterly rolling planning.

Read David’s articles.

- Time to get rolling (planning) AB UK Sept 2014

- Getting ready for rolling planning AB Oct 2014

- Roll model AB NovDec2014

- Why annual planning and budgeting is broken

- The 8 myths around annual budgeting and planning

- The Nine Foundation Stones of a Rapid Annual Planning Process

- The 10 common problems with spreadsheets

- How to sell the move away from annual budgeting and planning

- 10 areas where spreadsheets have no place to be

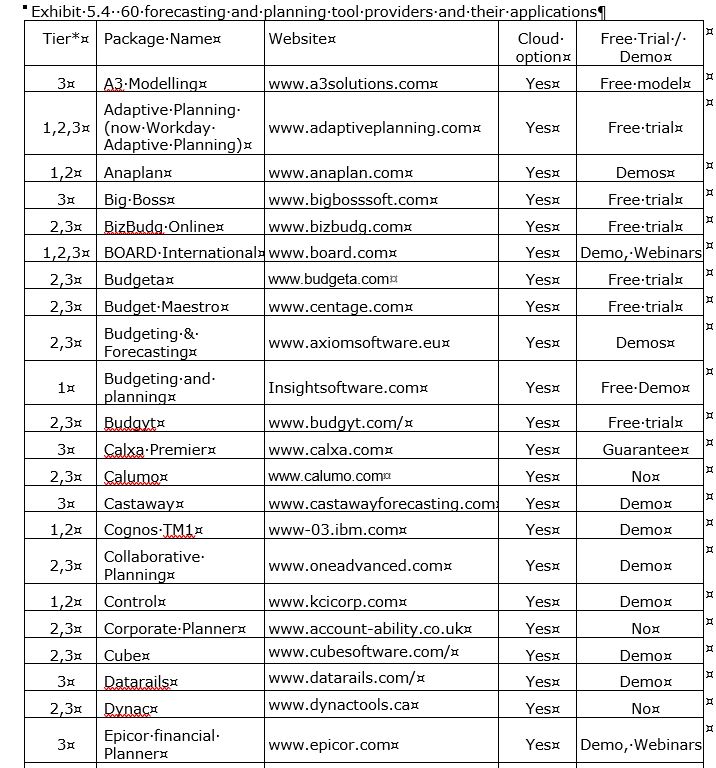

- 60 forecasting and planning tool providers and their applications

- 8 Annual planning templates to get you started

- A ten slide forecasting tool sales pitch

Other sources:

- Stop Wasting Your Time On Annual Budgeting

- Beyond Budgeting – an agile management model for new business and people – Bjarte Bogsne, at USI

- https://review.firstround.com/Annual-Planning-is-Killing-Your-Growth-Try-This-Instead

- https://hbr.org/2006/01/stop-making-plans-start-making-decisions

- https://corporatefinanceinstitute.com/resources/knowledge/finance/beyond-budgeting/

Seven of the top twenty mistakes a finance team make are connected to annual planning

Too many accountants fail to leave any legacy systems when they move on. They are simply good processors, performing each month-end as slow as the one before, overseeing a long and tedious annual planning process, and producing reports that are seldom read.

Too many accountants fail to leave any legacy systems when they move on. They are simply good processors, performing each month-end as slow as the one before, overseeing a long and tedious annual planning process, and producing reports that are seldom read.

Joseph Heller’s iconic 1961 book introduced a new phase into our language “Catch 22” which the Oxford English Dictionary defined as:

“A situation in which a desired outcome or solution is impossible to attain because of a set of inherently illogical rules or conditions”

I see many finance teams in this situation. The late monthly accounts, the long, drawn-out annual planning process and annual reporting cycle leave no time to break this cycle – a perfect Catch 22. The finance team needs to create time for change, to have more time to implement. Where do we find this time? We find it by adopting the lean processes used by our peers.

Through benchmarking and then delivering courses to finance teams across the world I have concluded that there are twenty mistakes.

- Allowing month-end reporting to go past three working days

- Taking months doing an annual plan – when it can be done in 10 working days

- Letting Excel dominate the finance system

- Not investing enough in accounts payable.

- Not adopting the purchasing card (a free, accounts payable system)

- Investing in a complex G/L and then upgrading it too frequently

- Having over 80 account codes for the P/L

- Budgeting at account code level

- Breaking down the annual plan into twelve before the year starts

- Giving budget holders an annual funding entitlement

- Only forecasting to year-end

- Not producing daily/ weekly decision based reports

- Producing numbing monthly financial reports

- Reporting on the wrong performance measures which can damage performance

- Selling change by logic instead of the emotional drivers of the buyer

- Using Julius Caesar’s calendar instead of 4,4,5-week months

- Spending months on the annual accounts

- Working hard but not smart

- Holding onto time wasting habits

- Not investing enough time to attract and recruit talented staff

The fixes are covered in my toolkit called “How to avoid the twenty major mistakes corporate accountants commonly make every year” – (PDF 110 page whitepaper + e-templates)

How should my finance team be performing?

Imagine your Finance team making history rather than just reporting on it. Imagine your month-end reporting being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

We can make this a reality. I’m David Parmenter. I am the author of The Financial Controllers and CFO’s Toolkit 3 rd Edition. It is a follow-on from Winning CFOs and Pareto’s 80/20 for Corporate Accountants.

|

|

|

| Click here to read more about the book | This was the second book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition | This was the first book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition |

Look inside the breakthrough finance team better practices book

A look inside the book – a 25 page extract

Download the chapter 14 on “Attracting and recruiting talent”

Download the chapter 3 on “Rapid month-end reporting: by day three or less”

Download the chapter 16 on Implementing quarterly rolling forecasting and planning

Testimonials on The Financial Controllers and CFO’s Toolkit 3rd edition

The nine foundation stones of an efficient annual budgeting and planning process (Extract from the toolkit)

There are a number of foundation stones that need to be laid before we can commence a project on reducing the annual plan to two weeks.

There are a number of foundation stones that need to be laid before we can commence a project on reducing the annual plan to two weeks.

- Separation of targets from the annual plan

- Bolt down your strategy beforehand

- Avoid monthly phasing the annual budget

- The annual plan does not give an annual entitlement to spend

- Budget committee commit to a “lock-up”

- Planning at a detailed level does not lead to a better prediction of the future

- Get it wrong quicker

- Built in a planning application – not in spreadsheets

- Plan with months that consist of 4 or 5 weeks

1. Separation of targets from the annual plan

It is so important to tell management the truth rather than what they want to hear. Boards and the senior management team have often been confused between setting stretch targets and a planning process. Planning should always be related to reality. The Board may want a 20% growth in net profit, yet management may see that only 10% is achievable with existing capacity constraints. The performance gap should be reported to the Board so they can direct their attention to strategic decisions to manage the short fall. The Board have every right to say the stretch target is the basis for the bonus.

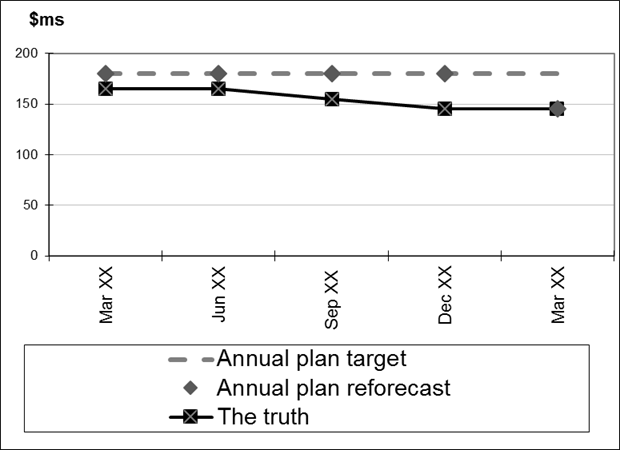

Exhibit 1 shows where management have forced the plan prepared in March to meet the target set by the Board. Each subsequent reforecast continues the charade until in the final quarter reforecast, performed in March the following year, the truth is revealed.

Exhibit 1: Reporting what the Board want to hear

2.Bolt down your strategy beforehand

Leading organizations always have a strategic workshop out of town. This session should be looked anticipated with a positive attitude. Normally Board members will be involved as their strategic vision is a valuable asset. These retreats are run by an experienced external facilitator. The key strategic assumptions are thus set before the annual planning round starts, also the Board can set out what they are expecting to see.

It is important that the board and management separate out in their minds the difference between a target — for example, the board wants a $200m net profit next year — and the annual plan forecast of $180m. It serves no purpose to lie to the board by fixing the annual plan to come up with $200m when you know it cannot be achieved. This is hiding the performance gap.

3. Avoid monthly phasing of the annual plan

As accountants we like things to balance. It is neat and tidy. Thus it appeared logical to break the annual plan down in to twelve monthly breaks before the year had started. We could have been more flexible. Instead we created a reporting yardstick that undermined our value to the organization. Every month we make management, all around the organization, write variance analysis which I could do just as well from my office in New Zealand. “it is a timing difference….” “we were not expecting this to happen”, “the market conditions have changed radically since the Plan” etc.

The monthly targets should be set a quarter ahead using a quarterly rolling forecasting process. This change has a major impact on reporting. We no longer will be reporting against a monthly budget that was set, in some cases, over 12 months before the period being reviewed.

4. The annual plan does not give an annual entitlement to spend

The annual plan should not create an entitlement, it should merely be an indication, the funding being based on a quarterly rolling basis, a quarter ahead each time.

Asking budget holders what they want and then, after many arguments, giving them an ‘annual entitlement’ to funding is the worse form of management we have ever presided over.

Organisations are recognising the folly of giving a budget holder the right to spend an annual sum, while at the same time saying if you get it wrong there will be no more money. By forcing budget holders to second-guess their needs in this inflexible regime you enforce a defensive behaviour, a stock piling mentality. In other words you guarantee dysfunctional behaviour from day one!

The nine year old’s birthday cake

The annual planning process has a lot in common with the handling of a nine year old’s birthday cake. A clever parent says to Johnny, here is the first slice, if you finish that slice, and are not going “green around the gills” and want more, I will give you a second slice. Instead, what we do in the annual planning process is divide the cake up and portion all of it to the budget holders. Like 9 year olds, budget holders lick the edges of their cake so even if they do not need all of it nobody else can have it. Why not, like the clever parent, give the manager what they need for the first three months, and then say “what do you need for the next three months” and so on. Each time we can apportion the amount that is appropriate for the conditions at that time.

5. Budget committee commit to a “lock-up”

Most organizations have a budget committee comprising CEO, CFO, and two general managers. You need to persuade this budget committee that a three day lock-up, whereby the committee sits for up to three days, is more efficient than the current scenario that stretches over months.

During the three day lock-up each budget holder has a set time to:

- Discuss their financial and nonfinancial goals for the next year

- Justify their annual plan forecast

- Raise extra funding issues

- Raise key issues (e.g., the revenue forecast is contingent on the release to market and commissioning of products X and Y)

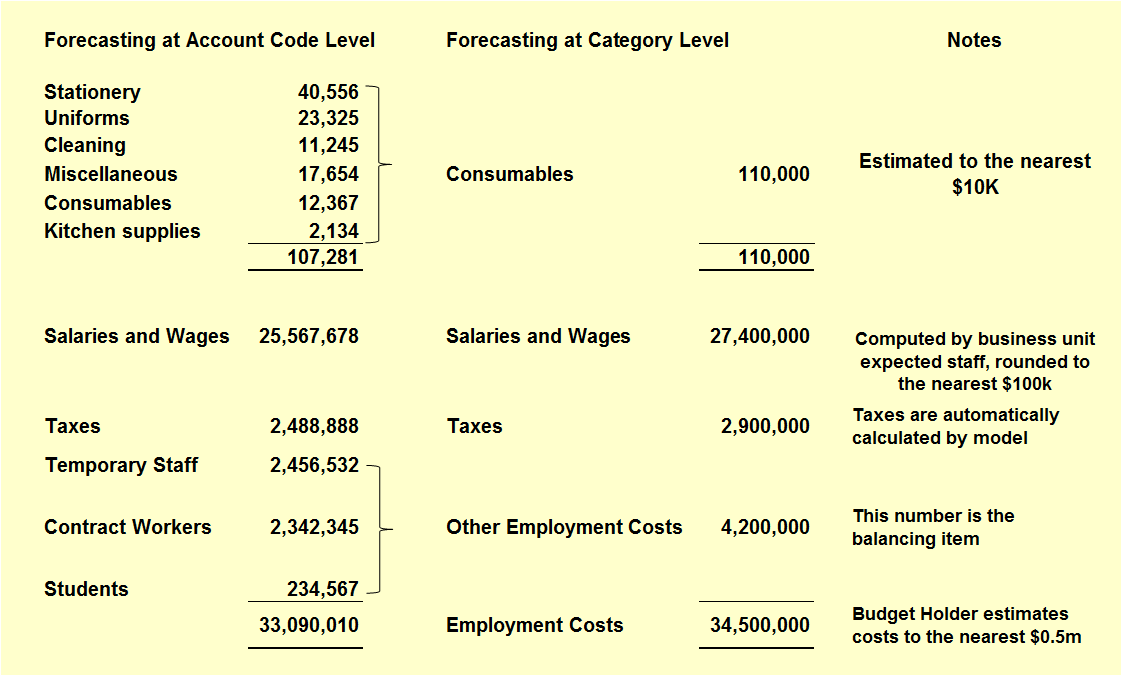

6. Budget at category level rather than account code level

A forecast is a view of the future. It will never, can never be right. As Harry Mills says it is better to be nearly right than precisely wrong”. Looking at detail does not help you see the future better, in fact I would argue it screens you from the obvious.

Whilst precision is paramount when building a bridge, ever small detail needs to be right, an annual plan should concentrate on the key drivers and large numbers.

Following this logic it is now clear that as accountants we never needed to set budgets at account code level. We simply have done it because we did it in the previous year. Do you need a budget at account code level if you have good trend analysis captured in the reporting tool? I think not. We therefore apply Pareto’s 80/20 and establish a series of category headings which include a number of general ledger (G/L) codes.

Rules I have developed:

- budget for an account code if the account is over 10% of total expenditure or revenue e.g. show revenue line if revenue category is over 10% of total revenue. If account code is under 10% amalgamate it with others until you get it over 10%. I call these categories. Thus a category will have a number of account codes within it. See Exhibit 2 for an example.

- limit the categories that BH’s need to forecast to no more than twelve

- select the categories that can be automated, and provide these numbers

- map the G/L account codes to these categories – a planning tool can easily cope with this issue without the need for a revisit of the chart of accounts.

Exhibit 2: How Forecasting Model Consolidates Account Codes

7. Get it wrong quicker

The CEO needs to make a fast time frame non negotiable in all communication with staff.

From the memo that goes out to invite Budget holders to the first annual planning workshop, the address of the attendees at the workshop, and the daily chasing up of the laggards during the three days Budget holders have to complete their annual plan the message is clear . We want a ‘fast light touch’ annual plan. ‘Fast’ in that the annual plan is completed in less than two weeks and ‘light touch’ in that unnecessary detail is avoided.

As part of this foundation stone, common templates are established to replace the myriad of spreadsheets.

8. Built in a planning tool—not in a spreadsheet

Annual planning requires a good robust tool not a spreadsheet, built by some innovative accountant, which now no one can understand. Often the main hurdle is the finance team’s reluctance to divorce itself from Excel. It has been a long and comfortable marriage albeit one that has limited the finance team’s performance.

Acquiring a planning tool is the first main step forward, and one that needs to be pursued not only for the organisation’s future but also for the finance team members’ future careers. It will soon be a prerequisite to have planning tool experience, and conversely career limiting to be an Excel guru.

Excel is a great tool for a one-off costing estimate done while awaiting your plane. It is not and never should have been a building block for your company’s key financial systems. As an annual planning tool it fails on a number of counts:

- it has no proper version control, we have all burnt the midnight oil pulling our hair out wondering whether all spreadsheets are the correct versions!!

- for every 150 lines there is a 90% chance of a logic error (from a recent study)

- its lack of robustness (show me a CFO who can be confident of the number an Excel forecast churns out!)

- it cannot accommodate changes to assumptions quickly e.g. what would you do if the CEO asking ”what if we stop production of computer printers, please tell me the impact by close of play today”, I suspect the best thing would be to pray!

- it is designed by accounting staff who; are not programmers, have not been trained in system documentation, quality assurance etc which you might expect from a designer of a core company system.

- “planning tools”

- “quarterly rolling forecasting” + “applications”

- “forecasting tools” + “rolling”

The key steps to making a good selection process include:

- workshop the QRF process using a focus group

- seek approval of draft proposal from the focus group

- research planning tool providers and prepare a short list thus avoiding a request of information (RFIs) unless you want to handle over 60 RFIs

- establish selection criteria and issue RFP on preferred three suppliers

- organise testing of the best two planning applications by contracting the consultants to model some of the required key features. Both teams should be paid a set fee so that you can keep the intellectual property developed

- presentation to decision makers and the focus groups

9. Plan with periods that are either 4 or 5 weeks long

The calendar in use today can be a major hindrance in forecasting. With the weekdays and number of weekend days, in any given month, being different from the next month, forecasting and reporting can be unnecessarily compromised. Closing off the month on a weekend can make a big positive impact in all sectors.

Forecasting models should be based on a “4, 4, 5 quarter”; that is, two four-week months and one five-week month are in each quarter, regardless of whether the monthly reporting has moved over to this regime. Calculating and forecasting the following items then becomes easier:

- For retail, you either have four or five complete weekends (the high-revenue days).

- You have either four weeks of salary or five weeks of salary.

- Power, telecommunications, and property-related costs. These can be automated and be much more accurate than a monthly allocation.

- Monthly targets. You can simply adjust back based on calendar or working days.

Simply design the model so that smoothing back to the regular calendar can be removed easily when you decided to migrate reporting to 4- or 5-week months.

To make progress in this area, I recommend to that you contact your general ledger supplier and ask, “Who is a very sophisticated user of this general ledger and who uses 4, 4, 5 reporting months?” Arrange to visit them and see how it works for them. Ask them, “Would you go back to regular calendar reporting?” Most are likely to give you a look that says, “Are you crazy?”

Next steps

1. Read my articles

2. Buy my toolkit “An Annual Plan in Two Weeks or Less Toolkit (Whitepaper + e-templates)

3. Deliver a compelling presentation to the C-Suite using the Etemplate provided in the toolkit